3 Ways To Deal With Required Minimum Distributions

Helping clients manage their Required Minimum Distributions (RMDs) is a weekly occurence. If you have ever contributed to a tax deferred retirement account [Traditional IRA, 401(k), 403(b), SEP IRA, Simple IRA, etc.] the IRS will require you to distribute an amount based on your life expectancy at a certain age. The law surrounding required minimum distributions have been volatile over the past few years.

Recent History of RMDs

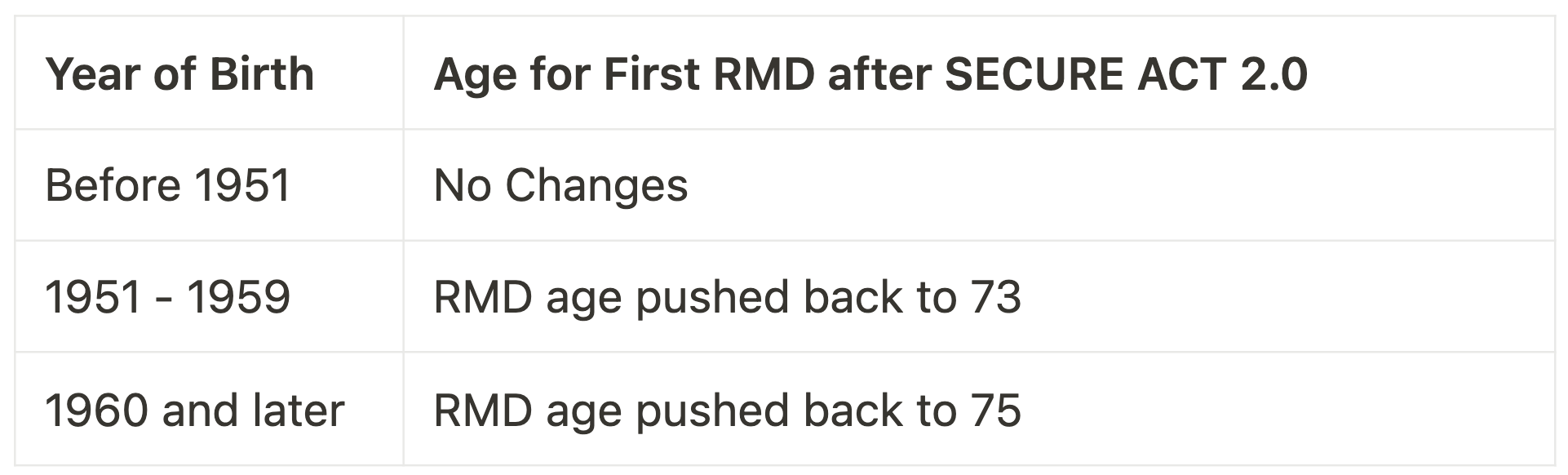

For many years retirees had to take RMDs beginning at age 70½. In 2023, Congress passed legislation known as the SECURE ACT that increased RMD ages to reflect that people are living and working longer. While I’m glad the IRS is no longer using a “½” age, they did keep it from being easy by having different RMD ages based on your year of birth:

Suffice for now, here's a helpful Schwab RMD calculator I use all the time. They tend to do a good job of updating the calculator as new legislation is passed. There is a separate calculator for beneficiary IRAs, which are subject to separate rules. Once you know the amount of your RMD, it’s up to you to decide how to satisfy it. Here are three common ways:

(1) Withhold Taxes And Send RMD To Your Bank

Most clients have saved money during their working years so they could actually spend that money during their retirement years. By far the most common method, clients will request to have their Federal and State taxes withheld from their RMD and the net amount to their linked bank account for living expenses.

Some clients will have an idea of what withholding rate they would like to use, but in many cases I’m helping my clients decide a federal tax withholding rate based on their other income. This is often the most challenging part of taking an RMD - knowing how much to withhold so you don’t have a larger than expected tax liability come tax filing time. Most of our clients are in Tennessee where there is no state income tax, which makes this step a bit easier. Remember, tax withholding rates on RMDs are not set in stone. If you have to pay in too much this year (or you get a larger than expected refund) you can adjust the tax withholding rate the following year.

Also, it can be a good idea at the beginning of the year to determine what your RMD liability will be. Many of our clients will want to split that annual RMD amount into monthly distribution amounts to help for budgeting and spending purposes. It’s ok to go over your RMD amount, but it’s not an option to come in under your RMD. It’s prudent to re-check at the end of the year that your did, in fact, satisfy your full RMD amount.

(2) Re-invest Your RMD

For some, there isn’t a need for income from their IRA. Perhaps there is enough income coming from other sources (pension, Social Security, rental income, etc.) to more than cover their living expenses, and the goal would be to grow their investments as much as possible through retirement. Instead of taking your RMD as income, one alternative is to reinvest your RMD. All the IRS cares about is you paying the taxes you owe. Here’s how that works in practice:

Client calls and says they need to take their $35,000 RMD from their IRA. They live in Tennessee (no state income tax) and want to withhold 22% for Federal Taxes.

If the client doesn’t have a taxable (non-IRA) investment account, now would be a good time to complete the account paperwork to do so. The client needs a place to re-invest their RMD and an Individual Taxable Account or a Joint Taxable Account (if they have a spouse) would likely be the best place to do that.

Once the taxable investment account is open, the client would need to fill out and sign a form instructing the custodian to distribute $35,000 from their IRA to the taxable account and request the 22% Federal and 0% State withholding. This is usually processed in just a couple business days. The net amount ($27,300) is reinvested in the market and continues to grow.

When the custodian makes the transfer they will go ahead and send the 22% Federal Withholding taxes ($7,700 in this example) to the IRS. The following February the client will receive a Form 1099-R indicating the custodian has already sent the IRS the $7,700.

The net result of this method is that Federal and State taxes are paid and the net funds (~$27,300) have been removed from the Traditional IRA and reinvested in a taxable account. The funds in the taxable investment account do not have the same investing benefits of the Traditional IRA (deferral of taxes). Instead taxable accounts mean you will be taxed on interest, dividends, and capital gains realized in the account. While that does sound much worse, it can be managed around. In some cases, you may find long-term capital gains rates can work out quite well!

(3) Giving Your RMD To A Qualified Charitable Organization

For many of our clients, they are in the fortunate position to have more funds than they need for living expenses. Many have charitable organizations or causes they want to provide financial support to. One of the best ways for our retiree clients to give to a charitable organization is through something known as a Qualified Charitable Distribution more often known as a QCD.

Once you turn 70 ½ you are eligible to execute a QCD. A QCD allows you to transfer an amount from your Traditional IRA to a qualified charitable organization without having to pay tax. An individual can donate up to $105,000 in QCDs in 2024. Post Tax Cut Jobs Act 2017, a majority of our clients tend to claim the standard deduction on their tax return making QCDs an attractive default mindset to donate their IRA funds. Finally, and very important to some, the QCD amount you donate is allowed to count towards your RMD for the year. Here’s how this one works:

Client calls and says they have a $15,000 RMD from their IRA. They do not need the RMD amount as income for the year and instead would like to donate it to their local church, which is a qualified charitable organization.

For this client, a QCD is likely a better idea than writing a check from their checking account. The funds in their checking account they have already paid taxes on. Instead of writing a check, doing a QCD allows them to transfer taxable IRA funds to their church without themselves paying any tax, without their church paying any tax, and while also having the QCD amount count towards satisfying their RMD.

I would have the client provide me a the name of the church, address of the church, the amount ($15k in this case), whether the check needs to be sent C/O anyone particular at their church, and whether they would like their name included on the check. There can be some strategy here as you may want to donate to a charitable organization anonymously as to avoid being put on future mailing lists. The key to a QCD is the check must be mailed directly from your custodian (Schwab, Fidelity, etc.) to the charitable organization - you don’t want it written out to you! An IRA distribution form would be sent to this client to sign, instructing the custodian where to send the check.

The challenging part of a QCD is making sure you remember you did it come time to file your tax return. The custodians don’t know whether the organization you are sending the check is a qualified charitable organization. On the 1099-R tax form they send you the following year, it will show the QCD amount as a normal distribution from your IRA. You need to make sure you remind your tax prepare of the QCD amounts you made so you don’t get double taxed - the opposite effect you intended when making the contribution!

Whether you need the RMD income or not for living expenses, if you do any charitable giving, it could be helpful to review QCDs and determine if they might should be included in your financial plan for the year.

You Don’t Have To Pick Just One Strategy!

You are able to mix and match the strategies listed above in the way that best accomplishes your financial goals. Many of our clients do have some kind of charitable giving but it may not be their full RMD amount. It could make sense to send out a QCD to match their giving amount, take some of the RMD as additional taxable income for spending purposes, and then re-invest the rest for long-term growth.