IRMAA and Medicare: Unmasking the Scary Surcharge for Retirees

As Halloween approaches, let's delve into a topic that often sends shivers down the spines of retirees - IRMAA for Medicare!

IRMAA, which stands for Income Related Monthly Adjustment Amount, is an additional surcharge on Medicare beneficiaries' Part B and Part D premiums when their income exceeds certain thresholds. It's not a permanent increase but is based on your tax return from two years prior. Many retirees are unfamiliar with this spooky feature of Medicare, and today I aim to shed some light on this surcharge. While paying extra for Medicare isn't pleasant, our goal is to ensure you're not avoiding important financial planning that could trigger an IRMAA surcharge but prove highly beneficial in the long run.

How IRMAA Income Works

Let's first address the income thresholds that trigger IRMAA. While most retirees won't face it, many of my clients do. [Note: MAGI stands for Modified Adjusted Gross Income, and the values below are for tax year 2024 based on 2022 tax returns (2025 thresholds should be released in the next month or two)]

Most retiree income sources count towards this IRMAA MAGI level, including Social Security, pensions, IRA or 401k withdrawals, investment interest, dividends, and annuity payments. However, two areas that can catch you off guard are capital gains from taxable (brokerage) investment accounts and Roth Conversions.

For instance, consider a married couple with a MAGI of $150,000. They might not be subject to the increased Medicare IRMAA surcharge. However, if they perform a $75,000 Roth Conversion one year, two years later they'll receive a notice from Medicare that their premiums are increasing for the following year. I've had a few of these phone calls, and believe me, nobody is thrilled to pay more for their Medicare. I've even had clients we warned about triggering an increased Medicare charge (which we were okay with), but two years later, they struggle to recall why it happened. They just see the increased Medicare costs and wonder if there's been a mistake.

It's worth noting that Medicare IRMAA brackets are now linked to inflation. When I first started in this industry, they were fixed, and each year more of our clients were triggering IRMAA charges. Since 2020, this has changed, and now we eagerly await the newly updated inflation brackets each year.

How I Do IRMAA Planning With Clients

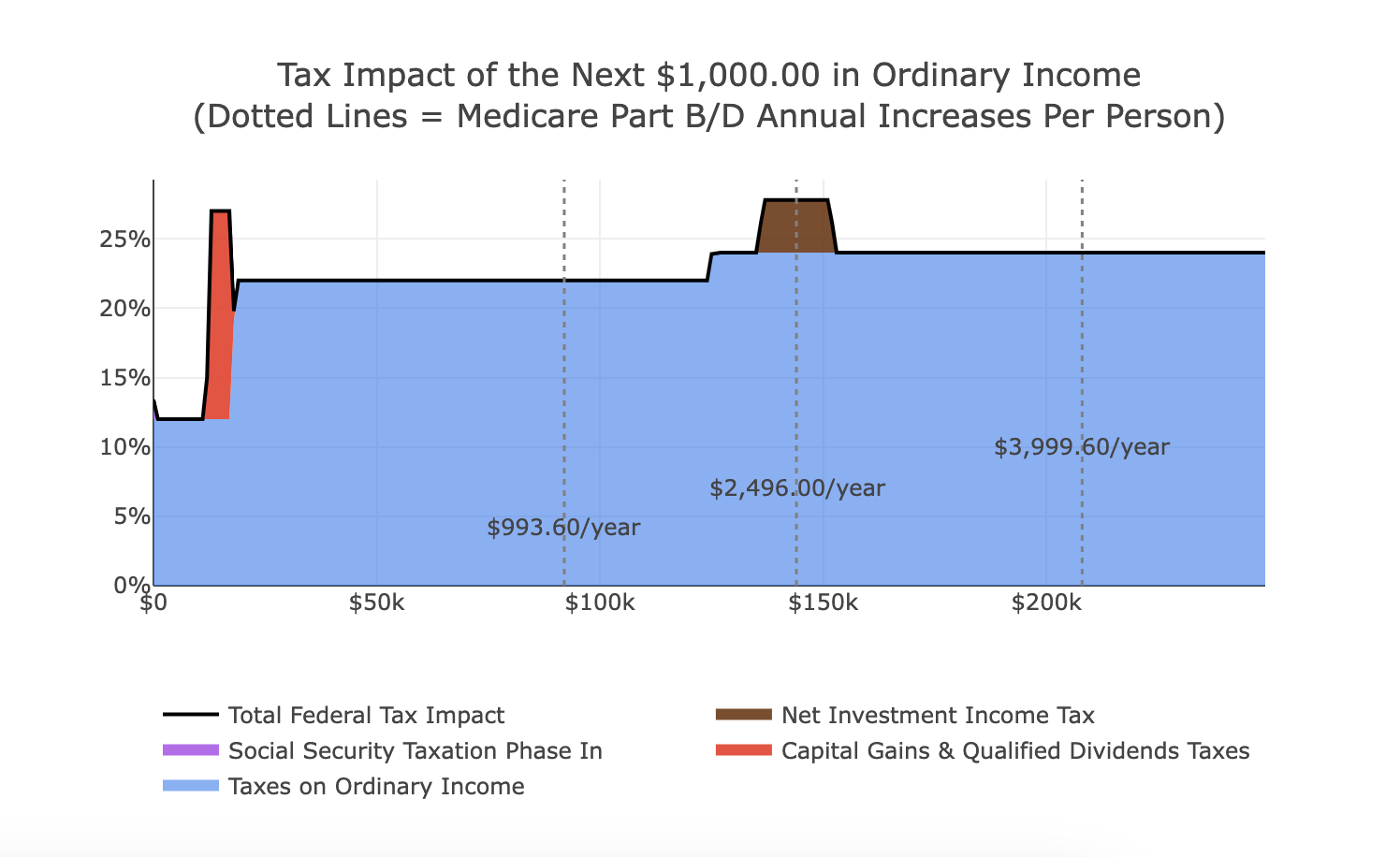

To navigate the complexities of IRMAA, I utilize tax planning software (Holistiplan) that helps me understand the key income thresholds that trigger a Medicare IRMAA charge. With a prior year tax return, a collaborative meeting with a client to update last year's numbers with current data, and sometimes making a few estimates between the projection date and year-end, I can generate what my tax planning software calls a Range Analyzer.

The Range Analyzer is a powerful tool I use with clients that shows the tax impact of the next $1,000 of ordinary income created. For example, if a sample, hypothetical client executed a $50,000 Roth Conversion, the marginal tax rate of the conversion would be 22%. The dotted vertical lines represent the income thresholds of IRMAA charges.

For a married couple, if they create $92,000 of additional income in 2024 (e.g., from a Roth Conversion), they will pay $993.60 per year, per person two years in the future (2026) for a total of $1,987.20. If they converted $144k, they would hit the second IRMAA threshold and pay $4,992 ($208/month/person) extra in 2026. You can also see the marginal rate of the Roth Conversion now jumps up to the 24% tax bracket.

As a financial planner, what I really want to avoid is an unintentional crossover of an IRMAA threshold by just a few dollars. Triggering an IRMAA surcharge by doing a $100K Roth Conversion seems like an oversight and poor planning. You'd almost rather be just under the $92K IRMAA threshold or go all the way up to a $124K Roth Conversion to stay under the 24% tax bracket and still short of the next $2,495.00/year per person IRMAA threshold.

While we've discussed Roth Conversions as an intentional financial and tax planning strategy, many of my clients have large taxable brokerage accounts that can generate significant short and long-term capital gains, unintentionally. IRMAA planning becomes even more crucial for these clients because those capital gains can be very uneven year-to-year and create large swings in MAGI levels.

Let's consider our same couple, but now assume they have a $150K long-term capital gain due to a decent market year and some withdrawals for expenses. Here's how their Range Analyzer would look:

The shape of our Range Analyzer might not look too different, but rest assured, it is! Notice the IRMAA premiums are now $3,999.60/year per person ($7,999.20 total) and $5,502.00/year per person ($11,004 total). This is because long-term capital gains count towards your IRMAA income, but they're treated separately from your ordinary income. You can see from the chart above that an additional $9,000 of taxable ordinary income would still be taxed at 12%. So if you're like some of my clients who might have a fairly normal income (Social Security, Pension, annuity income) but a large taxable investment account, a good market year might cause the dreaded IRMAA to appear. Conversely, a year with significant capital losses will impact your planning as well.

Why IRMAA Doesn’t Bother Me As Much As It Used To

My perspective on IRMAA charges has evolved over the years. As a financial planner based in Tennessee, I think it's important to highlight to many of my clients one of our state's most attractive features for retirees - the lack of a state income tax, and the repealed Hall tax since 2021 that previously taxed interest and dividend income from investments. Many retirees in other states don't have this same advantage from a state income tax perspective.

Because IRMAA charges are not a permanent penalty and aren't paid indefinitely, I think it's important not to miss the forest for the trees. Let's take, for example, a married client that pays a one-time Medicare IRMAA annual charge of $1,987.20 in efforts to convert $90,000 of their Traditional IRA to Roth. If their income tax bracket is expected to increase, or maybe they just feel the benefits of locking in the lower tax rates of the 2017 TCJA is worth it, I believe the IRMAA charge can be worth it by itself. If my clients lived in other states, the Roth Conversion itself might be taxed.

It's also worth considering going deep into Medicare IRMAA premiums in one year rather than paying lower IRMAA charges for longer. This kind of situation needs to be carefully modeled, keeping in mind that the future can't be predicted from a market or legislative perspective. Tax brackets could go up or down, and market performance could be worse than we expect.

Conclusion

Nobody I've met gets excited about paying extra for Medicare. In fact, IRMAA is often a monthly reminder that you've paid a lot into Medicare over your lifetime and now you have to pay more than your peers. With that said, I think it's crucial not to let emotions prevent you from doing the comprehensive financial planning necessary to help you reduce taxes (and SURCHARGES!) over a lifetime. While IRMAA is an important consideration, it shouldn't be the sole driver of your financial decisions. Remember, the goal is to optimize your overall financial picture, not just avoid IRMAA.

As always, while I provide tax planning guidance as part of comprehensive financial planning, it's important to consult with a tax professional for advice tailored to your specific situation. Also, keep in mind that IRMAA thresholds are subject to change, so it's wise to stay informed with the most current information from official sources.